#Events - FTT22 takeaways: A community where FinTechs, merchants, and digital identity solutions come together to rethink the future

All things Creators

8

min read

December 22, 2022

The FinTech Talents (FTT) event in London, organized by VC Innovations, brought three worlds together: identity, payments, and retail. Olyn was delighted to be involved in discussions aiming to unlock synergy between these three ecosystems.

We were excited for our CEO, Ana Maria Jipa, and our COO, Jeremias Buireo Karpp, to feature as panelists on the main stage. They furthered the debate on the journey to mainstreaming digital identity in Web3. Also, the two brought the myriad use cases of blockchain into the limelight beyond the run-of-the-mill cryptocurrency use case.

Fundamentally, these talks hit the most critical points in Web3: education for the user, formal consensus, bridges, partnerships, and thorough regulation.

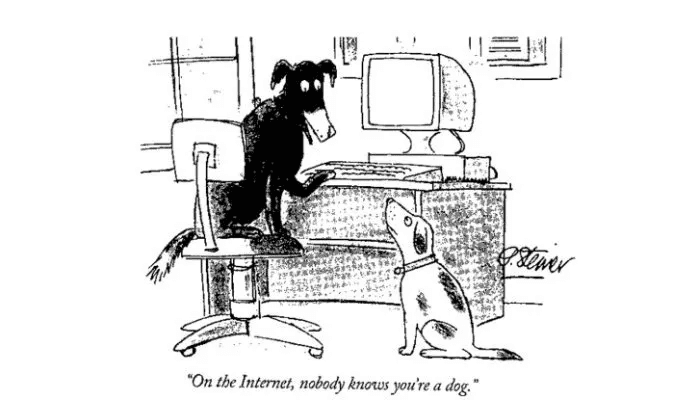

Digital identity and the future of the internet

Techies have said that the original sin of web1 was that there was no money in it. The internet was not a trusted network, so there were a few reasons to become economically involved on the internet. As a result, the internet’s evolution found a path through a dense forest of advertisements. We now have a consumer economy with an internet built for marketing.

With blockchain technology, however, the innovators of tomorrow can go back and fix this problem. The core “haves” of the internet that Olyn envisions for the future are as follows:

Encryption

A system for money

A system for identity

PayPal unlocked a new era for the internet when it was founded in 1998. It brought payments to a level of accessibility, effectively enabling payments on the web. More recently, business minds have been huddled around payment systems in Web2. Since payments became an embedded technology has turned every company into a Fintech.

Every company will be an identity company.

Multiple discussions have been held in the past years where we came to a common understanding that in the same way the internet web2 embedded the payment layer into the internet, every company that issues enables their users to hold an account, will become an identity company, authenticating users through their web activity.

Blockchain-based products beyond FinTech

For conservative thinkers who don’t believe blockchain to be necessary, these “haves”

Encryption

A system for money

A system for identity

may not outweigh the perceived efficacy of the internet as we use it now. The internet is often praised as an “information superhighway”—a centralized one. However, blockchain will not slow or dampen the accessibility of information. Information will become decentralized, meaningful, accessible, portable, and interoperable.

Think of it as an API where each call sits on a ledger.

Olyn was one of the very first companies to build on Solana in 2020 (at that time, the fastest and cheapest chain, the two most important factors for a startup like ours) with the aim of tokenizing physical and digital assets. Our vision was that blockchain will (through the NFT) enable consumers to attain ownership from payments and store the title of ownership on a wallet; the built-in capabilities around holding an inventory of purchased assets (digital and physical) is by turning every buyer into a merchant, enabling them to re-sell or place back in circulation the asset most securely and efficiently.

Jeremias Buireo, COO at Olyn was joined by Rizwan Pabani at Cardano Foundation, Oliver Studd at Valhalla Network, and Moderator Jocelyn Cheng from Luno Expeditions

Now more and more companies are rethinking consumption via blockchain solutions, enabling new interactions via the product. Recently, Olyn’s CEO, Ana Maria Jipa, came across a Web3 company, Club dVIN, which mints wine bottles of NFTs. “This is Vivino on Steroids,” says Ana; for those who love collecting wine, now once the bottle is opened and consumed, they get to collect the wine experience. Club dVIN, is showing us new ways of building community tools.

Our question remains, what blockchain use cases will prevail in this new climate?

Other discussions, “Rise of the Super Apps: The great rebundling”

While attending the panel “Rise of the Super Apps: The great rebundling,” we reborn our curiosity around clutter, brand positioning, and the West’s obsession with big-name brands.

Rise of the Super Apps: Felipe Martinez, CIO (Revolut), was joined by John Mazzara, Exec. EMEA, Payments Innovation (JP Morgan), Iana Dimitrova, Chief Executive (OpenPayd), Ken Johnstone, CPO (Mettle), Stewart McLean, Cofounder (Buom.app), and Moderator Richard Davies, CEO (Allica Bank) on the infrastructure stage to talk about mainstreaming cryptocurrency assets.

For those who are not familiar with the term, super apps are those that combine multiple services into one interface. Currently, they are popular in Asia and Africa. For USA, Europe, and Australia, super apps may develop through mergers or partnerships between players. For the time being, most super apps exist at the convergence of FinTech, shared mobility/transport, and food delivery platforms, etc. But tight data governance and antitrust regulations could impact this trend.

One event panelist, JP Morgan’s John Mazzara, offered a unique perspective on how people pick the best products for particular tasks. In the West, many consumers place brand loyalty at the top of their selection criteria, with little space for experimental clutter. The average person has 80 apps on their phone but only uses 8 daily. Even so, some companies are well positioned for super app status.

If one product or service becomes less available, a new competitor will surely replace it, but that kind of market anomaly is hard to come by. Super apps, which “rise to power” despite their big-name forebears, have to unwind years of brand loyalty to make it in the market.

Interestingly, these same super apps have varying degrees of control over their value chain. John Mazzara has seen companies who prefer to focus on their core competencies succeed and has also witnessed a high incidence of "Renaissance businesses"—businesses that tackle almost all aspects of their value chain and leave very little to, for example, external payment providers.

Whether a company decides to become licensed in payment or not, its brand positioning among all the clutter can get them where they want to go. The Olyn team felt this keenly at the FTT talks in London.